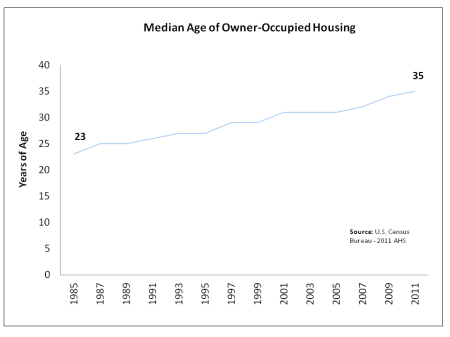

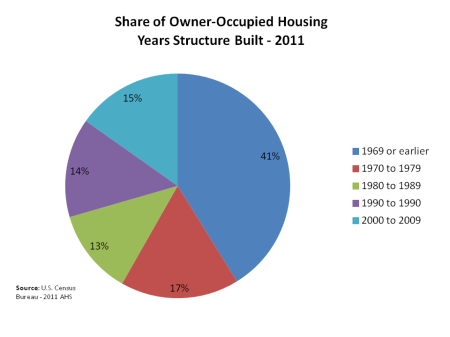

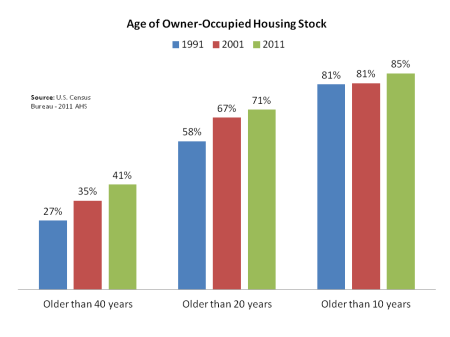

The American housing stock continues to age; a trend that represents an opportunity for remodelers and over the long term may signal a future increased demand for new home construction.

According to the latest data from the Department of Housing and Urban Development American Housing Survey (AHS), the median age of an owner-occupied home in the United States was 35 years old as of the 2011 survey. The median age reported in the 1985 AHS was only 23 years old.

Saturday, March 1, 2014

Thursday, January 9, 2014

Aging Boomers to Boost Demand for Apartments, Condos and Townhouses

The single-family home isn’t obsolete, yet. But the aging of the baby boomers could reshape the U.S. housing market and economy in the coming years.

Bloomberg News

As the boomers get older, many will move out of the houses where they raised families and move into cozier apartments, condominiums and townhouses (known as multifamily units in industry argot). A normal transition for individuals, but a huge shift in the country’s housing demand.

Based on demographic trends, the country should see a stronger rebound in multifamily construction than in single-family construction, Kansas City Fed senior economist Jordan Rappaport wrote in the most recent issue of the bank’s Economic Review. (Though he also notes slowing U.S. population growth “will put significant downward pressure on both single-family and multifamily construction.”)

Construction of multifamily buildings is expected to pick up strongly by early 2014, and single-family-home construction should regain strength by early 2015. “The longer term outlook is especially positive for multifamily construction, reflecting the aging of the baby boomers and an associated shift in demand from single-family to multifamily housing. By the end of the decade, multifamily construction is likely to peak at a level nearly two-thirds higher than its highest annual level during the 1990s and 2000s,” Mr. Rappaport wrote.

In contrast, when construction of single-family homes peaks at the end of the decade or beginning of the 2020s, he wrote, it’ll be “at a level comparable to what prevailed just prior to the housing boom.”

He says the shift from single-family homes to multifamily dwellings will have implications for fiscal policy (i.e. tax subsidies for homeownership), monetary-policy analysis and even local zoning codes. “Suburbs seeking to retain aging households may need to re-create a range of these urban amenities and enact some rezoning to encourage multifamily construction,” he said.

“More generally,” Mr. Rappaport wrote, “the projected shift from single-family to multifamily living will likely have many large, long-lasting effects on the U.S. economy. It will put downward pressure on single-family relative to multifamily house prices. It will shift consumer demand away from goods and services that complement large indoor space and a backyard toward goods and services more oriented toward living in an apartment. Similarly, the possible shift toward city living may dampen demand for automobiles, highways, and gasoline but increase demand for restaurants, city parks, and high-quality public transit. Households, firms, and governments that correctly anticipate these changes are likely to especially benefit.”

The article, “The Demographic Shift From Single-Family to Multifamily Housing,” appeared in the Fourth Quarter 2013 edition of Economic Review.

By Ben Leubsdorf

Wednesday, December 18, 2013

Fed says to cut back on its economic stimulus beginning in Jan.

The U.S. economy is healthy enough to begin weaning it off the steady flow of stimulus the Federal Reserve has been supplying since the Great Recession, the central bank said Wednesday.

In a move that few expected, the Fed said it would be cutting its historic $85 billion a month program to boost the economy by about $10 billion per month beginning in January.

"Information received since the Federal Open Market Committee met in October indicates that economic activity is expanding at a moderate pace," the Fed said in a statement released at the end of a two-day meeting to set policy.

The Fed also said the labor market has improved further, household spending and business investment advanced and inflation expectations are stable.

The upbeat tone of the statement boosted stocks. The Dow Jones industrial average jumped 150 points shortly after the news.

"They finally pulled a Band-aid off that they've been tugging at for a long time. The initial reaction is that tightening will be bad for stocks, but upon further reflection investors realize that to some extent tightening represents a view that the economy is stronger and can survive higher rates," Rick Meckler, president of hedge fund Libertyview Capital Management told Reuters.

To cushion the impact on financial markets, the Fed strengthened its commitment to record-low short-term rates. It says it plans to hold its key short-term rate near zero "well past" the time when unemployment falls below 6.5 percent.

In his last new conference as Fed chief, Bernanke said the Fed would trim the stimulus program more at future meetings, depending on economic conditions. Vice chair Janet Yellen is the presumed successor when Bernanke steps down in January.

Bernanke warned, however, that the economy remains in need of the Fed's aid.

"Today's policy actions reflect the committee's assessment that the economy is continuing to make progress but that it also has much farther to travel before conditions can be judged normal," he said. "Notably despite significant fiscal headwinds, the economy has been expanding at a moderate pace and we expect that growth will pick up somewhat in the coming quarters helped by highly accommodative monetary policy and waning fiscal drag."

The Fed's action comes after encouraging reports that show the economy is accelerating.

Hiring has been robust for four straight months. Unemployment is at a five-year low of 7 percent. Factory output is up. Consumers are spending more at retailers. Auto sales haven't been better since the recession ended 4½ years ago.

What's more, the stock market is near all-time highs. Inflation remains below the Fed's target rate. And the House has passed a budget plan that seems likely to avert another government shutdown next year. The Senate is expected to follow suit.

One factor of concern for some members is inflation, which remains historically low. The Fed's optimal rate is 2 percent. For the 12 months ending in October, consumer inflation as measured by the Fed's preferred index is just 0.7 percent, well below its target.

But the Fed sees inflation slowly moving toward its target, according to its most recent economic projections that were released Wednesday. The Fed projects inflation would range between 1.4 percent and 1.6 percent next year and could reach the Fed's target in 2015 at the earliest.

Fed officials still project economic growth of roughly 3 percent next year. But they are slightly more optimistic about unemployment, predicting it could fall as low as 6.3 percent in 2014, down from a low of 6.4 percent forecasted in September.

Nine of the voting members of the FOMC supported the decision to start tapering. Only Boston Fed President Eric Rosengren dissented, noting the elevated unemployment rate and inflation below the 2-percent target.

After nearly eight years, Ben Bernanke is stepping down as Fed chairman early next year. His designated successor, Vice Chair Janet Yellen, faces Senate confirmation this week. Yellen is known to lean dovish in her stance—favoring easy policy like Bernanke—which would likely bode well with markets.

The Associated Press and CNBC's JeeYeon Park contributed to this report.

In a move that few expected, the Fed said it would be cutting its historic $85 billion a month program to boost the economy by about $10 billion per month beginning in January.

"Information received since the Federal Open Market Committee met in October indicates that economic activity is expanding at a moderate pace," the Fed said in a statement released at the end of a two-day meeting to set policy.

The Fed also said the labor market has improved further, household spending and business investment advanced and inflation expectations are stable.

The upbeat tone of the statement boosted stocks. The Dow Jones industrial average jumped 150 points shortly after the news.

"They finally pulled a Band-aid off that they've been tugging at for a long time. The initial reaction is that tightening will be bad for stocks, but upon further reflection investors realize that to some extent tightening represents a view that the economy is stronger and can survive higher rates," Rick Meckler, president of hedge fund Libertyview Capital Management told Reuters.

To cushion the impact on financial markets, the Fed strengthened its commitment to record-low short-term rates. It says it plans to hold its key short-term rate near zero "well past" the time when unemployment falls below 6.5 percent.

In his last new conference as Fed chief, Bernanke said the Fed would trim the stimulus program more at future meetings, depending on economic conditions. Vice chair Janet Yellen is the presumed successor when Bernanke steps down in January.

Bernanke warned, however, that the economy remains in need of the Fed's aid.

"Today's policy actions reflect the committee's assessment that the economy is continuing to make progress but that it also has much farther to travel before conditions can be judged normal," he said. "Notably despite significant fiscal headwinds, the economy has been expanding at a moderate pace and we expect that growth will pick up somewhat in the coming quarters helped by highly accommodative monetary policy and waning fiscal drag."

The Fed's action comes after encouraging reports that show the economy is accelerating.

Hiring has been robust for four straight months. Unemployment is at a five-year low of 7 percent. Factory output is up. Consumers are spending more at retailers. Auto sales haven't been better since the recession ended 4½ years ago.

What's more, the stock market is near all-time highs. Inflation remains below the Fed's target rate. And the House has passed a budget plan that seems likely to avert another government shutdown next year. The Senate is expected to follow suit.

One factor of concern for some members is inflation, which remains historically low. The Fed's optimal rate is 2 percent. For the 12 months ending in October, consumer inflation as measured by the Fed's preferred index is just 0.7 percent, well below its target.

But the Fed sees inflation slowly moving toward its target, according to its most recent economic projections that were released Wednesday. The Fed projects inflation would range between 1.4 percent and 1.6 percent next year and could reach the Fed's target in 2015 at the earliest.

Fed officials still project economic growth of roughly 3 percent next year. But they are slightly more optimistic about unemployment, predicting it could fall as low as 6.3 percent in 2014, down from a low of 6.4 percent forecasted in September.

Nine of the voting members of the FOMC supported the decision to start tapering. Only Boston Fed President Eric Rosengren dissented, noting the elevated unemployment rate and inflation below the 2-percent target.

After nearly eight years, Ben Bernanke is stepping down as Fed chairman early next year. His designated successor, Vice Chair Janet Yellen, faces Senate confirmation this week. Yellen is known to lean dovish in her stance—favoring easy policy like Bernanke—which would likely bode well with markets.

The Associated Press and CNBC's JeeYeon Park contributed to this report.

Sunday, December 8, 2013

Soaring new home sales: Not what they seem

It was the sharpest jump in more than three decades, but housing watchers are already poking holes in the new home sales numbers. After delays due to the government shutdown, data for both September and October were released together, in addition to a large downward revision for August. Follow the numbers, and the gains are not quite what the headline seems.

Contracts signed to buy newly built homes jumped 25.4 percent in October month to month, after falling 6.6 percent in September from August. The seasonally adjusted annual rate went from an originally reported 421,000 units in August, which was revised down to 379,000 units, and to 354,000 units in September. The number for September was a 10 percent drop from September of 2012. It then rose to 444,000 units in October. There is a nearly 20 percent margin of error on all these numbers.

"The October 'preliminary' report released this morning, along with the terrible August and September data, is the outlier and will be revised lower next month in line with the new trend lower that began in July," noted housing analyst Mark Hanson.

August sales estimates were revised down by 15 percent on an unadjusted basis and September sales dropped from there.

—By CNBC's Diana Olick.

Contracts signed to buy newly built homes jumped 25.4 percent in October month to month, after falling 6.6 percent in September from August. The seasonally adjusted annual rate went from an originally reported 421,000 units in August, which was revised down to 379,000 units, and to 354,000 units in September. The number for September was a 10 percent drop from September of 2012. It then rose to 444,000 units in October. There is a nearly 20 percent margin of error on all these numbers.

"The October 'preliminary' report released this morning, along with the terrible August and September data, is the outlier and will be revised lower next month in line with the new trend lower that began in July," noted housing analyst Mark Hanson.

August sales estimates were revised down by 15 percent on an unadjusted basis and September sales dropped from there.

"Both the September and October new home sales data were released together and averaged 399,000 annualized versus the estimate of 424,000 and compares with the average year-to-date of 422,000," said Peter Boockvar, chief market analyst of economic advisory firm The Lindsey Group. "The weakness seen in July through September was clearly in response to the rise in rates and the almost 25-basis-point decrease in mortgage rates in October seemed to have brought out buyers that were previously on the fence."

Builders say it wasn't just the falling rates, but the end of the government shutdown.

"I think it built up some pent up demand," said Alan Laing, CEO of Pennsylvania-based Orleans Homes. "We saw immediately after the resolution, traffic and sales got better in the second half of October."

The short drop in mortgage rates may not, in fact, have had as much of an impact on sales as some think. Lower prices may have. The median price of a new home sold in October was $245,200, a drop of 1 percent from a year ago. While that may not seem like a lot, it is the lowest monthly median since November of 2012. Prices have been going up dramatically on an annual basis for both the builders and for existing home sales.

The mortgage rate card can actually be played both ways. Steven Alloy, president of Virginia-based Stanley Martin Homes, said rising rates will drive more home sales, not less.

"If you are somebody considering buying a house, one of your great fears is that rates go up, so if they start to move, people will start to believe that they will keep moving, and as soon as they believe they are going keep moving they are going to come out in droves," he said.

Mortgage rates have jumped dramatically in just the last week on positive economic data. The average rate on the 30-year fixed conforming loan hit 4.51 percent last week, according to the Mortgage Bankers Association, but are already higher today. Should the monthly jobs report released on Friday be better than expected, interest rates will surge ever higher.

Builders say it wasn't just the falling rates, but the end of the government shutdown.

"I think it built up some pent up demand," said Alan Laing, CEO of Pennsylvania-based Orleans Homes. "We saw immediately after the resolution, traffic and sales got better in the second half of October."

The short drop in mortgage rates may not, in fact, have had as much of an impact on sales as some think. Lower prices may have. The median price of a new home sold in October was $245,200, a drop of 1 percent from a year ago. While that may not seem like a lot, it is the lowest monthly median since November of 2012. Prices have been going up dramatically on an annual basis for both the builders and for existing home sales.

The mortgage rate card can actually be played both ways. Steven Alloy, president of Virginia-based Stanley Martin Homes, said rising rates will drive more home sales, not less.

"If you are somebody considering buying a house, one of your great fears is that rates go up, so if they start to move, people will start to believe that they will keep moving, and as soon as they believe they are going keep moving they are going to come out in droves," he said.

Mortgage rates have jumped dramatically in just the last week on positive economic data. The average rate on the 30-year fixed conforming loan hit 4.51 percent last week, according to the Mortgage Bankers Association, but are already higher today. Should the monthly jobs report released on Friday be better than expected, interest rates will surge ever higher.

—By CNBC's Diana Olick.

Monday, November 25, 2013

Housing market showing more signs of fraying at the edges

Signed contracts to buy existing homes fell for the fifth straight month in October, as the government shutdown added to an overall slowdown in the U.S. housing market. So-called pending home sales eased 0.6 percent from an upwardly revised September reading and are down 1.6 percent from October 2012, according to the National Association of Realtors.

—By CNBC's Diana Olick

This is the lowest sales pace since December 2012. Pending home sales are an indicator of closed sales in November and December.

"The government shutdown in the first half of last month sidelined some potential buyers. In a survey, 17 percent of Realtors reported delays in October, mostly from waiting for IRS income verification for mortgage approval," said Lawrence Yun, chief economist for the Realtors in a release.

Regionally, gains in pending home sales in the Northeast and Midwest were stronger, while the South and West saw deeper declines. Sales rose 2.8 percent month-to-month in the Northeast and 1.2 percent in the Midwest. Sales slipped 0.8 percent in the South from September and in the West the decline was steepest, with 4.1 percent fewer buyers signing contracts.

"We could rebound a bit from this level, but still face the headwinds of limited inventory and falling affordability conditions. Job creation and a slight dialing down from current stringent mortgage underwriting standards going into 2014 can help offset the headwind factors," Yun said.

While the Realtors' survey, which draws its data from regional multiple listing services, showed a big drop in the usually investor-heavy West, another report saw investors returning to the market in October after stepping back earlier in the year. After surging to 23 percent of the market in February, investors made up just 16.6 percent of home buyers in August, according to Campbell/Inside Mortgage Finance. Over the past two months, however, that share has climbed back to 17.4 percent.

"The two-month rise in investor activity is significant given that it occurred at the same time the proportion of distressed properties in the housing market has continued to fall," the report said.

"The government shutdown in the first half of last month sidelined some potential buyers. In a survey, 17 percent of Realtors reported delays in October, mostly from waiting for IRS income verification for mortgage approval," said Lawrence Yun, chief economist for the Realtors in a release.

Regionally, gains in pending home sales in the Northeast and Midwest were stronger, while the South and West saw deeper declines. Sales rose 2.8 percent month-to-month in the Northeast and 1.2 percent in the Midwest. Sales slipped 0.8 percent in the South from September and in the West the decline was steepest, with 4.1 percent fewer buyers signing contracts.

"We could rebound a bit from this level, but still face the headwinds of limited inventory and falling affordability conditions. Job creation and a slight dialing down from current stringent mortgage underwriting standards going into 2014 can help offset the headwind factors," Yun said.

While the Realtors' survey, which draws its data from regional multiple listing services, showed a big drop in the usually investor-heavy West, another report saw investors returning to the market in October after stepping back earlier in the year. After surging to 23 percent of the market in February, investors made up just 16.6 percent of home buyers in August, according to Campbell/Inside Mortgage Finance. Over the past two months, however, that share has climbed back to 17.4 percent.

"The two-month rise in investor activity is significant given that it occurred at the same time the proportion of distressed properties in the housing market has continued to fall," the report said.

Wednesday, October 23, 2013

Sales of bank-owned homes decline in California as markets get closer to normal

Sales of bank-owned homes constituted a majority of California home sales as recently as four years ago, but now represent a small fraction of sales in the state, according to data that Realtors are pointing to as evidence of continued recovery in the real estate market.

“In the beginning of 2009, 60 percent of the closings in our state were REOs (repossessed homes),” California Association of Realtors chief economist Leslie Appleton-Young said in a Tuesday conference call. “Now it’s around 5 percent of total sales.”

“In the beginning of 2009, 60 percent of the closings in our state were REOs (repossessed homes),” California Association of Realtors chief economist Leslie Appleton-Young said in a Tuesday conference call. “Now it’s around 5 percent of total sales.”

Appleton-Young on Tuesday presented the Realtors’ forecast for the coming year during a conference call. Appleton-Young delivered her remarks on the same day that the Realtors group opened its California Realtor Expo at the Long Beach Convention Center.

In terms of pricing, the trade group is predicting the median price of a single-family home in California will rise to $432,800 in 2014. That figure would signify a 6 percent rise over the projected 2013 median of $408,600.

A median price of $408,600 would be 28 percent higher than last year’s prices, but a modest rate of appreciation combined with a diminishing proportion of bank-owned and other distressed homes among California real estate deals can be interpreted as one sign the state’s housing market is returning to a “normal” situation.

Concerning distressed properties — foreclosures and short sales — one analyst said a combination of factors including homeowners and banks finding alternatives to foreclosure, the policy impact of the state’s new Homeowners Bill of Rights and the fact that many foreclosures have already been processed has resulted in a downward trend in foreclosure activity.

The trend includes the Los Angeles and Southern California markets, said Daren Blomquist, spokesman for the Irvine-based RealtyTrac, a company that lists foreclosed properties and collects real estate data. Blomquist said foreclosure filings in Los Angeles and San Bernardino counties have fallen for the past 21 and 15 months respectively.

The Homeowners Bill of Rights is a package of laws that state Attorney General Kamala Harris and Democratic lawmakers pushed for last year. The laws include several provisions to prevent or delay foreclosures, including a ban on “dual tracking” activities in which banks work on a homeowner’s loan modification request while simultaneously processing a foreclosure.

He also said banks became more willing to let homeowners pursue short sales — deals in which houses were sold for less than the outstanding mortgage debt.

Blomquist said the laws resulted in a sharp decrease in foreclosure activity from December to January, but he predicted that many foreclosures would be merely delayed — not prevented — by the new laws.

Home prices have appreciated rapidly this year. In August, California prices rose to $441,330, which was about 28 percent higher than prices from 12 months prior, according to the California Association of Realtors. The figure also signified the highest price recorded since December 2007.

Realtors are projecting the rate of appreciation to cool off next year. Scott Underwood, a Long Beach-based broker, said upward movement in mortgage rates has calmed recent conditions in which a house may get a rush of offers as soon as it goes on the market. That makes it easier for parties on either side of the deal to assess a fair price.

In terms of pricing, the trade group is predicting the median price of a single-family home in California will rise to $432,800 in 2014. That figure would signify a 6 percent rise over the projected 2013 median of $408,600.

A median price of $408,600 would be 28 percent higher than last year’s prices, but a modest rate of appreciation combined with a diminishing proportion of bank-owned and other distressed homes among California real estate deals can be interpreted as one sign the state’s housing market is returning to a “normal” situation.

Concerning distressed properties — foreclosures and short sales — one analyst said a combination of factors including homeowners and banks finding alternatives to foreclosure, the policy impact of the state’s new Homeowners Bill of Rights and the fact that many foreclosures have already been processed has resulted in a downward trend in foreclosure activity.

The trend includes the Los Angeles and Southern California markets, said Daren Blomquist, spokesman for the Irvine-based RealtyTrac, a company that lists foreclosed properties and collects real estate data. Blomquist said foreclosure filings in Los Angeles and San Bernardino counties have fallen for the past 21 and 15 months respectively.

The Homeowners Bill of Rights is a package of laws that state Attorney General Kamala Harris and Democratic lawmakers pushed for last year. The laws include several provisions to prevent or delay foreclosures, including a ban on “dual tracking” activities in which banks work on a homeowner’s loan modification request while simultaneously processing a foreclosure.

He also said banks became more willing to let homeowners pursue short sales — deals in which houses were sold for less than the outstanding mortgage debt.

Blomquist said the laws resulted in a sharp decrease in foreclosure activity from December to January, but he predicted that many foreclosures would be merely delayed — not prevented — by the new laws.

Home prices have appreciated rapidly this year. In August, California prices rose to $441,330, which was about 28 percent higher than prices from 12 months prior, according to the California Association of Realtors. The figure also signified the highest price recorded since December 2007.

Realtors are projecting the rate of appreciation to cool off next year. Scott Underwood, a Long Beach-based broker, said upward movement in mortgage rates has calmed recent conditions in which a house may get a rush of offers as soon as it goes on the market. That makes it easier for parties on either side of the deal to assess a fair price.

“Now, all of a sudden, there’s less of a frenzy and it’s easier to work in (and) conceptualize for buyers and sellers,” he said.

The California Realtor Expo in Long Beach is a three-day convention for the real estate industry. Scheduled events for attendees include educational sessions on California demographics, property management, marketing and how to use data while interacting with clients.

The California Realtor Expo in Long Beach is a three-day convention for the real estate industry. Scheduled events for attendees include educational sessions on California demographics, property management, marketing and how to use data while interacting with clients.

Tuesday, September 24, 2013

Single family home prices rise, but at less feverish pace

U.S. single-family home prices rose in July, albeit at a slightly slower pace, a closely watched survey showed on Tuesday.

Even so, the year-on-year gain was the strongest in more than seven years.

The S&P/Case Shiller composite index of 20 metropolitan areas rose 0.6 percent on a seasonally adjusted basis, compared to economists' forecasts for a 0.8 percent gain. Prices rose 0.9 percent in June.

On a non-adjusted basis, prices rose 1.8 percent.

Compared to a year earlier, prices were up 12.4 percent, matching economists' expectations and marking the strongest rise since February 2006. Prices were up 12.1 percent in the year to June.

The report suggested the housing sector continues to recover despite a recent rise in mortgage costs. Economists have pointed to a stronger housing market as a bright spot in the U.S. economic rebound.

Prices in all 20 cities rose on a non-seasonally adjusted yearly basis, led by a 27.5 percent surge in Las Vegas and followed closely by a 24.8 percent gain in San Francisco.

Robert Shiller, one of the index's namesakes, said that Las Vegas figure gave him pause.

"I'm starting to worry about a bubble. In some cities it's looking bubbly now," Shiller told CNBC's "Squawk on the Street" Tuesday

"The really dramatic cities tend to be cities that had bubbles in the recent past - California, Phoenix, Vegas - It's regional somewhat. The northeast is relatively mild."

Shiller also cautioned the rally in prices could run out of steam soon.

"It might be slowing down, because the thing that's driving this doesn't seem to be excitement about a new era," he said. "It's a mixed picture and I don't know where home prices are going to go. This might be the beginning of a slowdown. It could be the beginning of a bubble."

Even so, the year-on-year gain was the strongest in more than seven years.

The S&P/Case Shiller composite index of 20 metropolitan areas rose 0.6 percent on a seasonally adjusted basis, compared to economists' forecasts for a 0.8 percent gain. Prices rose 0.9 percent in June.

On a non-adjusted basis, prices rose 1.8 percent.

Compared to a year earlier, prices were up 12.4 percent, matching economists' expectations and marking the strongest rise since February 2006. Prices were up 12.1 percent in the year to June.

The report suggested the housing sector continues to recover despite a recent rise in mortgage costs. Economists have pointed to a stronger housing market as a bright spot in the U.S. economic rebound.

Prices in all 20 cities rose on a non-seasonally adjusted yearly basis, led by a 27.5 percent surge in Las Vegas and followed closely by a 24.8 percent gain in San Francisco.

Robert Shiller, one of the index's namesakes, said that Las Vegas figure gave him pause.

"I'm starting to worry about a bubble. In some cities it's looking bubbly now," Shiller told CNBC's "Squawk on the Street" Tuesday

"The really dramatic cities tend to be cities that had bubbles in the recent past - California, Phoenix, Vegas - It's regional somewhat. The northeast is relatively mild."

Shiller also cautioned the rally in prices could run out of steam soon.

"It might be slowing down, because the thing that's driving this doesn't seem to be excitement about a new era," he said. "It's a mixed picture and I don't know where home prices are going to go. This might be the beginning of a slowdown. It could be the beginning of a bubble."

Subscribe to:

Posts (Atom)