Tuesday, December 16, 2014

Tuesday, April 15, 2014

Southern California median home price jumped to $400,000 in March

Home prices in Southern California are at their highest level in six years, according to new data, though those gains may be taking a bite out of sales volume.

The median price of a house sold in Southern California rose from $383,000 in February to $400,000 in March, the market’s highest level since February 2008, according to San Diego-based DataQuick, which tracks real estate data.

The figure is up 15.8% from the same month last year and is the first noticeable increase since the torrid run-up in prices last spring and summer.

At the same time, the number of sales fell on an annual basis for the sixth straight month as investors and cash buyers pull out in the face of higher prices, and more traditional home buyers hesitate to jump in. There were 17,638 homes sold in DataQuick's six-county Southern California' region, down 14.3% from last March and the second-lowest total for the month -- the start of the key spring home-buying season -- in nearly two decades.

“Southland home buying got off to a very slow start this year,” said DataQuick analyst Andrew LePage. “We see multiple reasons for this: The inventory of homes for sale remains thin in many markets. Investor purchases have fallen. The jump in home prices and mortgage rates over the past year has priced some people out of the market, while other would-be buyers struggle with credit hurdles. Also, some potential move-up buyers are holding back while they weigh whether to abandon a phenomenally low interest rate on their current mortgage in order to buy a different home.”

The data also show how the recovery is being felt differently at different segments of the market.

While prices have climbed fast on lower-priced homes, the number of sales has fallen sharply, suggesting a lack of homes for sale and buyers who can afford them. Sales of homes for less than $500,000 dropped 26.4% from this time last year.

Meanwhile, at the higher end, price and volume continue to rise, with sales of homes worth more than $500,000 up 2.9% from last year. Sales of homes worth more than $800,000 climbed 5.4%.

Across the region, prices grew fastest in San Bernardino County -- up 21.1% to $230,000 -- and Riverside County -- up 17.8% to $288,500 -- and slowest in Ventura County, up 6.6% to $430,000. The number of sales fell just 5.8% in Orange County, but was down 22% in Ventura County.

Saturday, March 1, 2014

The Aging Housing Stock

The American housing stock continues to age; a trend that represents an opportunity for remodelers and over the long term may signal a future increased demand for new home construction.

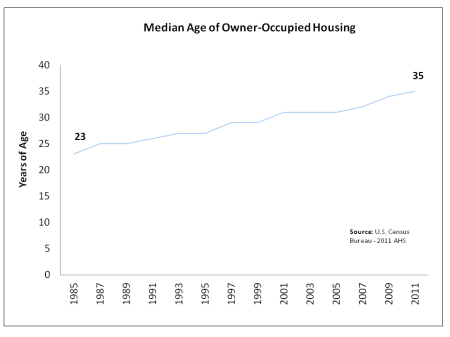

According to the latest data from the Department of Housing and Urban Development American Housing Survey (AHS), the median age of an owner-occupied home in the United States was 35 years old as of the 2011 survey. The median age reported in the 1985 AHS was only 23 years old.

According to the latest data from the Department of Housing and Urban Development American Housing Survey (AHS), the median age of an owner-occupied home in the United States was 35 years old as of the 2011 survey. The median age reported in the 1985 AHS was only 23 years old.

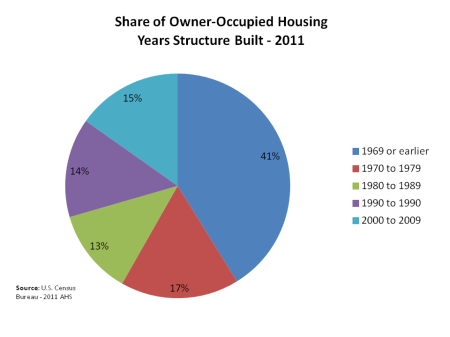

The 2011 AHS also found that 41% of the owner-occupied housing stock in the U.S. was built prior to 1969. Homes built from 2000 to 2009 account for 15% of the owner-occupied housing stock.

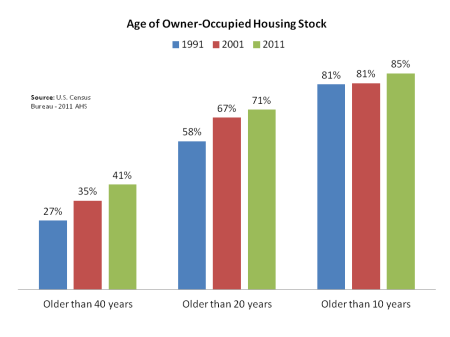

The share of the housing stock at least 40 years old, 41%, represents a significant increase over prior years. The share in 2001 was 35% and only 27% in 1991. The share of the housing stock at least 20 years old also increased significantly over the time period.

This information is important for housing demand, as older homes are less energy-efficient than new construction and will require remodeling or replacement in the years ahead. The aging housing stock represents an opportunity for well positioned builders and developers in areas where the population is not in decline.

The share of the housing stock at least 40 years old, 41%, represents a significant increase over prior years. The share in 2001 was 35% and only 27% in 1991. The share of the housing stock at least 20 years old also increased significantly over the time period.

This information is important for housing demand, as older homes are less energy-efficient than new construction and will require remodeling or replacement in the years ahead. The aging housing stock represents an opportunity for well positioned builders and developers in areas where the population is not in decline.

Thursday, January 9, 2014

Aging Boomers to Boost Demand for Apartments, Condos and Townhouses

The single-family home isn’t obsolete, yet. But the aging of the baby boomers could reshape the U.S. housing market and economy in the coming years.

Bloomberg News

As the boomers get older, many will move out of the houses where they raised families and move into cozier apartments, condominiums and townhouses (known as multifamily units in industry argot). A normal transition for individuals, but a huge shift in the country’s housing demand.

Based on demographic trends, the country should see a stronger rebound in multifamily construction than in single-family construction, Kansas City Fed senior economist Jordan Rappaport wrote in the most recent issue of the bank’s Economic Review. (Though he also notes slowing U.S. population growth “will put significant downward pressure on both single-family and multifamily construction.”)

Construction of multifamily buildings is expected to pick up strongly by early 2014, and single-family-home construction should regain strength by early 2015. “The longer term outlook is especially positive for multifamily construction, reflecting the aging of the baby boomers and an associated shift in demand from single-family to multifamily housing. By the end of the decade, multifamily construction is likely to peak at a level nearly two-thirds higher than its highest annual level during the 1990s and 2000s,” Mr. Rappaport wrote.

In contrast, when construction of single-family homes peaks at the end of the decade or beginning of the 2020s, he wrote, it’ll be “at a level comparable to what prevailed just prior to the housing boom.”

He says the shift from single-family homes to multifamily dwellings will have implications for fiscal policy (i.e. tax subsidies for homeownership), monetary-policy analysis and even local zoning codes. “Suburbs seeking to retain aging households may need to re-create a range of these urban amenities and enact some rezoning to encourage multifamily construction,” he said.

“More generally,” Mr. Rappaport wrote, “the projected shift from single-family to multifamily living will likely have many large, long-lasting effects on the U.S. economy. It will put downward pressure on single-family relative to multifamily house prices. It will shift consumer demand away from goods and services that complement large indoor space and a backyard toward goods and services more oriented toward living in an apartment. Similarly, the possible shift toward city living may dampen demand for automobiles, highways, and gasoline but increase demand for restaurants, city parks, and high-quality public transit. Households, firms, and governments that correctly anticipate these changes are likely to especially benefit.”

The article, “The Demographic Shift From Single-Family to Multifamily Housing,” appeared in the Fourth Quarter 2013 edition of Economic Review.

By Ben Leubsdorf

Subscribe to:

Posts (Atom)